Top CBDC Apps in 2025: Features, Benefits, and How to Use Them

Central Bank Digital Currencies (CBDCs) are transforming the way we perceive money. They are digital versions of national currencies, issued by central banks. This means they offer the ease of digital payments with the security of traditional money.

Over 130 countries are looking into CBDCs. Apps have become key for accessing these new financial systems. They make it easy for people to use CBDCs.

In this guide, we’ll look at the top CBDC apps for 2025. We’ll cover their main features, security, and benefits. This article is for anyone interested in central bank digital currencies and the best apps to use them.

Understanding CBDCs: Digital Cash for the Modern Era

CBDCs are the next step in money’s digital journey. Unlike Bitcoin, they are issued by national central banks. This makes them as reliable as cash.

CBDCs bring many benefits. They settle transactions fast, cut costs for international payments, and help the unbanked. They also offer better security and can be programmed for specific uses.

As CBDCs grow, apps have become the main way to use them. These apps act as digital wallets. They keep your money safe and make transactions easy.

Understanding CBDCs: Digital Cash for the Modern Era

Central Bank Digital Currencies represent the evolution of money in the digital age. Unlike cryptocurrencies such as Bitcoin, CBDCs are issued and regulated by national central banks, giving them the same legal tender status as physical cash. This official backing provides stability and trust that private digital currencies often lack.

CBDCs offer numerous advantages over traditional payment methods, including:

- Instant settlement of transactions

- Reduced costs for cross-border payments

- Financial inclusion for unbanked populations

- Enhanced security through digital verification

- Programmable money capabilities

As CBDCs continue to gain traction globally, specialized apps have emerged as the primary interface for users to access, store, and transact with these digital currencies. These apps serve as digital wallets, providing secure storage and convenient transaction capabilities for central bank digital currencies.

Top CBDC Apps in 2025

We’ve evaluated the leading CBDC applications based on security features, user experience, functionality, and adoption rates. Here are the standout performers that are shaping the future of digital currency:

1. Digital Yuan (e-CNY) App

Developer: People’s Bank of China

Availability: China (pilot cities including Beijing, Shanghai, Shenzhen)

China’s Digital Yuan app represents one of the most advanced CBDC implementations globally. The e-CNY app offers a comprehensive suite of features for managing China’s central bank digital currency, including wallet management, payment processing, and merchant integration.

4.7

User Rating

Security

4.8

User Experience

4.5

Features

4.7

Pros

- Offline payment capability via NFC

- Tiered wallet system for different user needs

Cons

- Limited to Chinese residents

- Some privacy concerns regarding transaction monitoring

2. Sand Dollar App

Developer: Central Bank of The Bahamas

Availability: The Bahamas (nationwide)

The Sand Dollar app supports the world’s first fully deployed CBDC. Launched in 2020, this pioneering application enables Bahamians to store and transact with the digital version of the Bahamian dollar, promoting financial inclusion across the island nation’s scattered geography.

4.3

User Rating

Security

4.4

User Experience

4.2

Features

4.3

Pros

- Works without internet connection

- Strong focus on financial inclusion

Cons

- Limited merchant adoption

- Basic interface compared to other financial apps

3. eRupee by SBI

Developer: State Bank of India

Availability: India (pilot regions)

The eRupee app by State Bank of India provides access to India’s digital rupee (e₹) as part of the Reserve Bank of India’s CBDC pilot program. This application serves as a digital wallet for the e₹, allowing users to make person-to-person and merchant payments with India’s central bank digital currency.

4.0

User Rating

Security

4.3

User Experience

3.8

Features

3.9

Pros

- Integration with existing banking infrastructure

- Multiple denomination support

Cons

- Limited to pilot participants

- Requires additional steps to load wallet

4. HDFC Bank Digital Rupee

Developer: HDFC Bank

Availability: India (pilot regions)

HDFC Bank’s Digital Rupee app provides another access point to India’s e₹ CBDC pilot. The application offers a secure digital wallet for storing and transacting with the digital rupee, featuring QR code payments and person-to-person transfers through the RBI’s CBDC network.

4.1

User Rating

Security

4.4

User Experience

4.0

Features

3.9

Pros

- Clean, intuitive interface

- Strong security features

Cons

- Limited merchant acceptance

- Requires HDFC Bank account for full functionality

5. DCash

Developer: Eastern Caribbean Central Bank

Availability: Eastern Caribbean Currency Union member states

DCash is the official app for the Eastern Caribbean Central Bank’s digital currency. Available across multiple island nations in the Eastern Caribbean Currency Union, DCash facilitates digital payments using the region’s CBDC, promoting financial inclusion and reducing cash dependency.

3.9

User Rating

Security

4.2

User Experience

3.7

Features

3.8

Pros

- Cross-border functionality within ECCU

- No bank account required for basic wallet

Cons

- Occasional connectivity issues

- Limited customer support

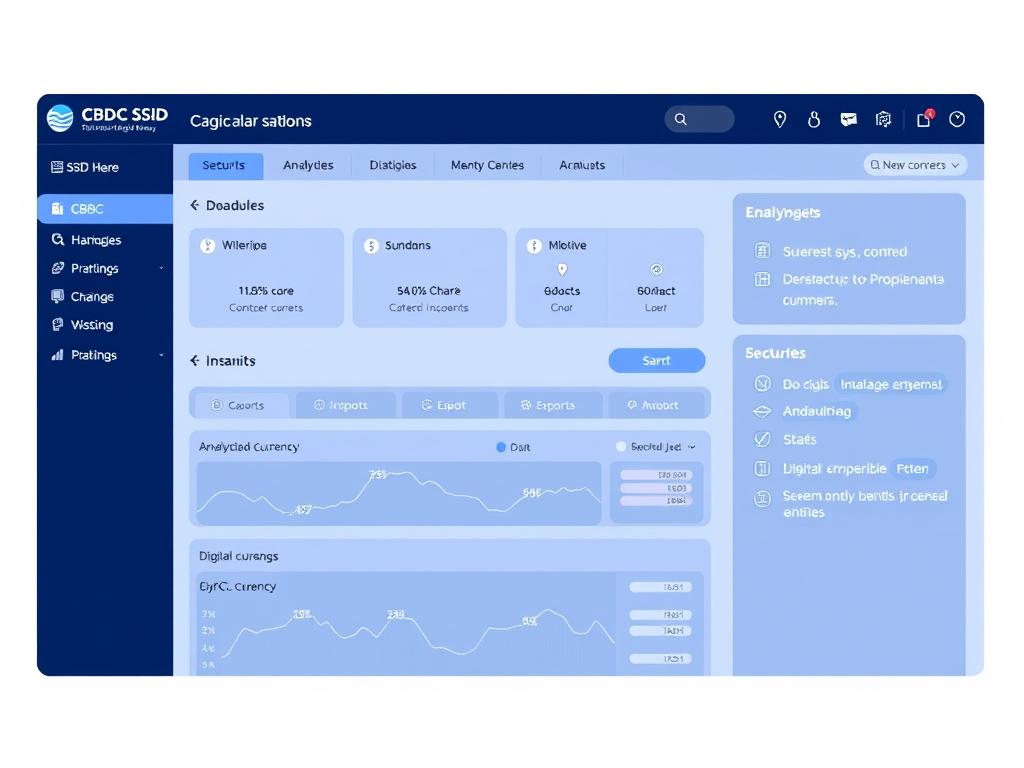

6. CBDC SSID App

Developer: Sovereign Wallet Network Pte. Ltd.

Availability: Global (for central banks and financial institutions)

Unlike consumer-focused apps, the CBDC SSID App is designed for central banks and financial institutions to issue and manage central bank digital currencies. This specialized application provides administrative tools for CBDC issuance, management, and regulatory compliance.

4.5

Professional Rating

Security

4.7

Functionality

4.5

Compliance

4.3

Pros

- Comprehensive CBDC management tools

- Built-in regulatory compliance features

Cons

- Not for individual consumers

- Requires significant technical expertise

7. Jam-Dex

Developer: Bank of Jamaica

Availability: Jamaica (nationwide)

Jam-Dex is Jamaica’s official CBDC wallet app, supporting the digital Jamaican dollar. Launched after a successful pilot program, this application enables Jamaicans to store, send, and receive the country’s central bank digital currency through a user-friendly mobile interface.

3.8

User Rating

Security

4.1

User Experience

3.6

Features

3.7

Pros

- No transaction fees

- Works with basic feature phones

Cons

- Limited advanced features

- Occasional synchronization issues

8. Digital Krona (e-krona)

Developer: Sveriges Riksbank

Availability: Sweden (pilot participants)

Sweden’s e-krona pilot app provides access to the Riksbank’s CBDC test environment. While still in the testing phase, this application demonstrates Sweden’s approach to creating a digital complement to cash, featuring a clean Scandinavian design and focus on user privacy.

4.2

Pilot Rating

Security

4.5

User Experience

4.2

Features

3.9

Pros

- Strong privacy protections

- Elegant, intuitive interface

Cons

- Limited to pilot participants

- Still in testing phase

CBDC App Comparison: Features and Capabilities

When choosing a CBDC app, it’s important to understand how they compare across key features and functionality. The table below provides a side-by-side comparison of the top CBDC apps to help you identify which best suits your needs:

| App Name | Offline Capability | Cross-Border | Transaction Fees | Biometric Security | Merchant Integration |

| Digital Yuan (e-CNY) | Yes | Limited | None | Yes | Extensive |

| Sand Dollar | Yes | No | None | Yes | Growing |

| eRupee by SBI | Limited | No | None | Yes | Limited |

| HDFC Bank Digital Rupee | Limited | No | None | Yes | Limited |

| DCash | No | Within ECCU | None | Optional | Moderate |

| CBDC SSID App | N/A | Yes | Configurable | Yes | N/A |

| Jam-Dex | Yes | No | None | Optional | Growing |

| Digital Krona | Testing | No | None | Yes | Testing |

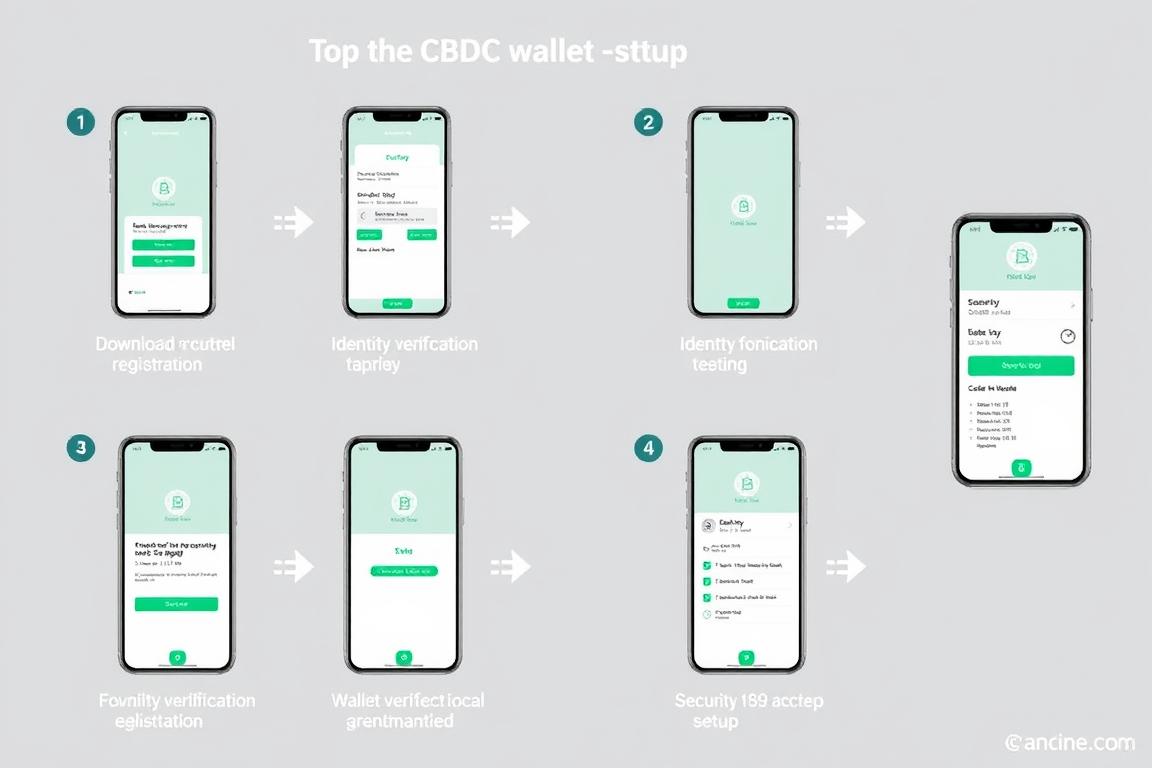

How to Use CBDC Apps: A Step-by-Step Guide

While specific steps may vary between different CBDC applications, the following guide provides a general overview of how to get started with most central bank digital currency apps:

Setting Up Your CBDC Wallet

- Download the app from your country’s official app store or the central bank’s website.

- Complete identity verification by providing required documentation (varies by country and app).

- Create a secure password and set up biometric authentication if available.

- Fund your wallet by transferring money from your bank account or visiting an authorized agent.

- Set up security features such as transaction limits and notifications.

Making Payments with CBDC Apps

- Person-to-Person Payments: Enter recipient’s phone number or scan their QR code, enter amount, and confirm.

- Merchant Payments: Scan the merchant’s QR code or let them scan yours, enter amount, and authorize.

- Offline Transactions: For apps with offline capability, ensure NFC is enabled or use the app’s offline mode.

- Recurring Payments: Set up scheduled transfers for regular payments where supported.

- Check transaction history to verify completed payments and monitor your spending.

Security Best Practices

- Never share your PIN or password with anyone

- Enable biometric authentication when available

- Set up transaction notifications to monitor activity

- Regularly update your app to the latest version

- Use secure, private networks when making transactions

The Future of CBDC Apps: Trends and Predictions

As central bank digital currencies continue to evolve, we can expect significant developments in the applications that support them. Here are key trends shaping the future of CBDC apps:

Cross-Border Integration

Future CBDC apps will likely feature enhanced cross-border functionality, allowing users to seamlessly transact across different national digital currencies. Projects like Project Dunbar and mBridge are already exploring multi-CBDC platforms that could enable this integration.

Programmable Money

Next-generation CBDC apps will incorporate programmable money features, enabling conditional payments, automated transactions, and integration with smart contracts. This functionality will support new business models and more efficient financial processes.

Enhanced Privacy

As privacy concerns grow, future CBDC apps will likely incorporate more sophisticated privacy-preserving technologies, potentially including zero-knowledge proofs and other cryptographic techniques that balance regulatory requirements with user privacy.

The integration of CBDCs with existing financial infrastructure will be crucial for widespread adoption. We can expect future apps to offer seamless connections with traditional banking services, payment networks, and digital financial platforms, creating a more unified user experience.

Conclusion: Choosing the Right CBDC App for Your Needs

Central bank digital currencies represent a significant evolution in how we interact with money, and the apps that support them are key to their successful adoption. When selecting a CBDC app, consider your specific needs and priorities:

- Digital Yuan app offers the most comprehensive features

- Sand Dollar provides excellent offline functionality

- eRupee and HDFC Bank Digital Rupee integrate well with existing banking

- Digital Yuan has the most extensive merchant integration

- DCash offers good regional functionality in the Caribbean

- Jam-Dex provides fee-free transactions for merchants

- CBDC SSID App provides comprehensive management tools

- Digital Krona demonstrates advanced privacy features

- Multiple apps can be studied for different implementation approaches

As CBDCs continue to develop globally, we can expect these apps to evolve with enhanced features, improved security, and greater interoperability. The top CBDC apps of today provide a glimpse into the future of digital currency, where central bank-issued digital money becomes an integral part of our financial lives.

Share Your CBDC App Experience

Have you used any of these CBDC apps? We’d love to hear about your experience! Share your thoughts, questions, or insights in the comments section below.Join the Discussion

Frequently Asked Questions About CBDC Apps

Are CBDC apps secure?

Yes, CBDC apps typically implement robust security measures including encryption, biometric authentication, and transaction monitoring. As official products of central banks or their authorized partners, these apps undergo rigorous security testing. However, users should still follow best practices such as using strong passwords and keeping their devices updated.

How do CBDC apps differ from cryptocurrency wallets?

While both store digital currency, CBDC apps hold central bank-issued digital versions of national currencies with legal tender status. Cryptocurrency wallets store privately issued digital assets without government backing. CBDC apps typically offer greater stability, regulatory compliance, and integration with traditional banking, while cryptocurrency wallets may offer more anonymity and decentralization.

Can I use CBDC apps for international payments?

Currently, most CBDC apps are limited to domestic use within their issuing country. However, cross-border CBDC functionality is a major focus of development, with several pilot programs exploring multi-CBDC platforms. Some regional CBDCs like DCash already offer limited cross-border functionality within their currency union.

Do I need a bank account to use a CBDC app?

This varies by country and implementation. Some CBDC apps require linking to a bank account for funding and identity verification, while others (like the Sand Dollar and some Digital Yuan wallets) offer basic functionality without a traditional bank account. This design choice reflects each central bank’s goals regarding financial inclusion.

Will CBDC apps replace traditional banking apps?

Rather than replacement, most central banks envision CBDC apps complementing traditional banking services. Many CBDC implementations follow a two-tier model where commercial banks and payment providers continue to interface with customers. In some cases, CBDC functionality may eventually be integrated into existing banking apps rather than requiring separate applications.