CBDC Meaning: What Are Central Bank Digital Currencies and How Do They Work?

Central Bank Digital Currency (CBDC) represents one of the most significant evolutions in monetary systems in decades. As cash usage declines and digital payment methods proliferate, central banks worldwide are exploring these government-backed digital currencies. But what exactly does CBDC mean, and why should you care about this financial innovation?

In this comprehensive guide, we’ll explore the CBDC meaning, how these digital currencies function, and their potential impact on our financial future. Unlike cryptocurrencies such as Bitcoin, CBDCs are issued and regulated by a nation’s monetary authority, combining the convenience of digital transactions with the stability and trust of traditional currency.

What Is a Central Bank Digital Currency (CBDC)?

A Central Bank Digital Currency (CBDC) is a digital form of a country’s official currency issued directly by its central bank. Unlike the digital money in your bank account or payment apps, which are liabilities of commercial banks, CBDCs are a direct liability of the central bank – just like physical cash.

Think of a CBDC as digital cash. While most money today exists digitally in bank accounts, these balances represent money that commercial banks owe you. A CBDC, however, would be money that the central bank itself owes you, eliminating the intermediary role of commercial banks for that portion of the money supply.

“A CBDC is a digital form of central bank money that is widely available to the general public. ‘Central bank money’ refers to money that is a liability of the central bank.”

– Federal Reserve

The concept has gained significant momentum in recent years, with over 130 countries and currency unions, representing 98% of global GDP, actively exploring CBDC implementation. This surge in interest stems from declining cash usage, the rise of cryptocurrencies, and the need for more efficient payment systems.

Types of CBDCs and How They Compare to Other Digital Currencies

Central banks are exploring different CBDC models to serve various purposes within the financial system. Understanding these distinctions helps clarify how CBDCs fit into the broader digital currency landscape.

Retail vs. Wholesale CBDCs

Retail CBDCs

Designed for the general public, retail CBDCs would be used for everyday transactions like buying groceries or paying bills. These are digital versions of cash that anyone can hold and use for person-to-person and consumer transactions.

Wholesale CBDCs

Reserved for financial institutions, wholesale CBDCs facilitate interbank settlements and large-value transfers. They’re not meant for everyday consumers but could make the financial system more efficient behind the scenes.

CBDC vs. Cryptocurrencies vs. Stablecoins

| Feature | CBDCs | Cryptocurrencies | Stablecoins |

| Issuer | Central banks | Decentralized networks | Private companies |

| Value Stability | Stable (like fiat currency) | Highly volatile | Designed to be stable |

| Regulation | Fully regulated | Limited regulation | Increasing regulation |

| Centralization | Centralized | Decentralized | Typically centralized |

| Backing | Government authority | Network consensus | Reserves (fiat, crypto, or algorithm) |

Unlike cryptocurrencies such as Bitcoin or Ethereum, CBDCs are not decentralized. They’re controlled by central banks, which can influence their supply and functioning. This centralization provides stability but removes the censorship-resistance that attracts many to cryptocurrencies.

Stablecoins attempt to bridge this gap by offering the stability of traditional currency with the digital nature of crypto. However, they’re issued by private companies rather than central banks, raising questions about reserve backing and regulation.

How CBDCs Work: Technology and Implementation

The technical architecture behind CBDCs varies by country and implementation model, but most share certain fundamental characteristics that define how they function.

Technology Options

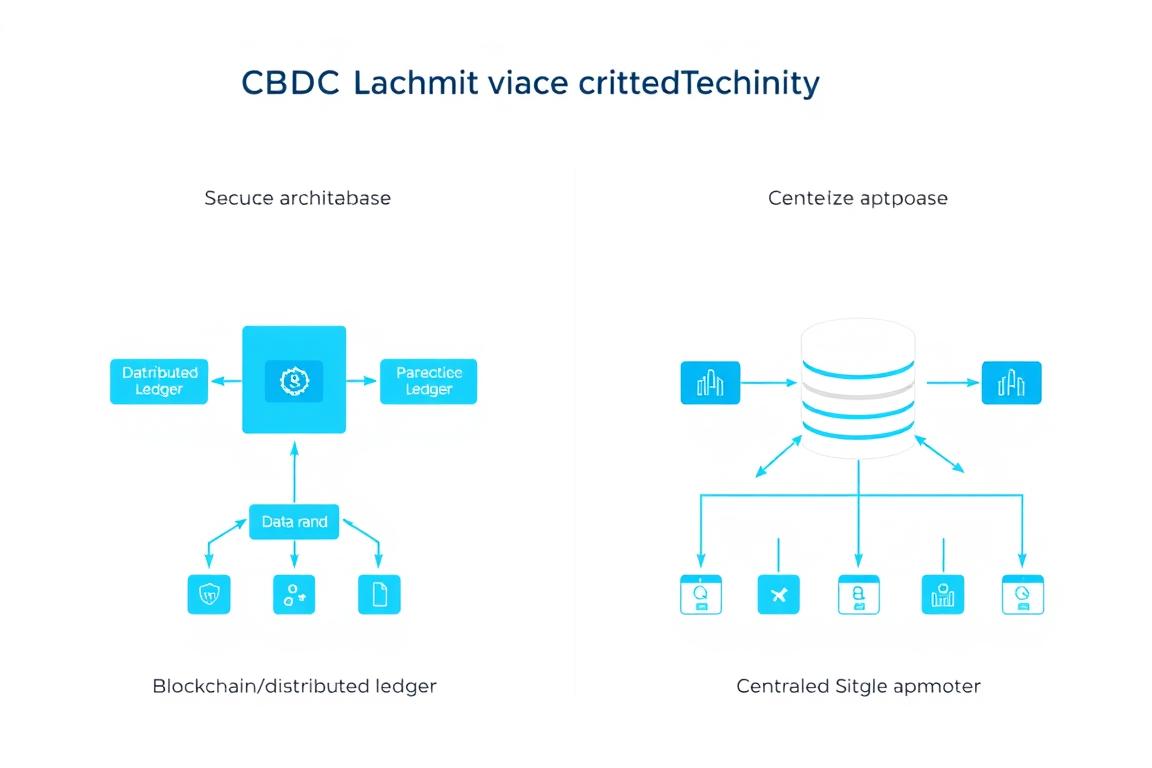

Distributed Ledger Technology (DLT)

Some CBDCs utilize blockchain or similar distributed ledger technologies, though typically in a permissioned format where the central bank controls who can validate transactions. This differs from public blockchains like Bitcoin, where anyone can participate in validation.

DLT can offer benefits like transaction transparency and resilience against certain types of system failures. However, it may face challenges with transaction speed and energy consumption.

Centralized Database Systems

Other CBDC models rely on traditional centralized database architecture, which can offer advantages in transaction speed and energy efficiency. These systems build upon existing financial infrastructure but with enhanced capabilities.

The Federal Reserve’s Project Hamilton, for example, has explored both DLT and non-DLT approaches to determine which best meets the needs of a potential U.S. CBDC.

Distribution Models

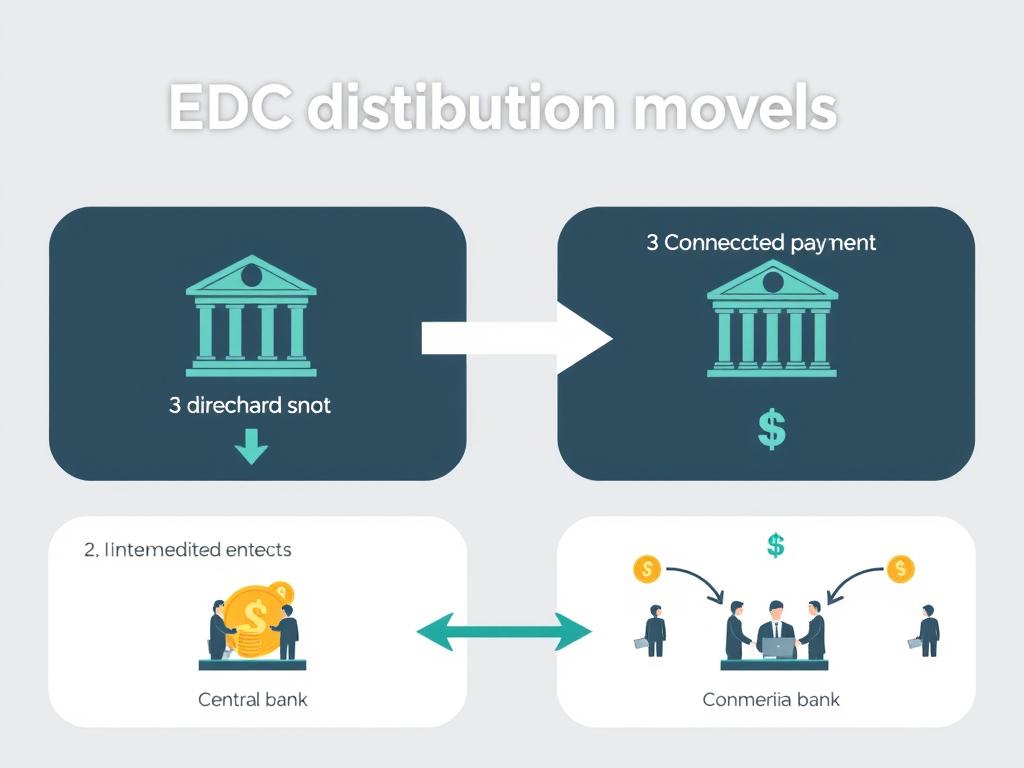

Direct Model

In a direct CBDC model, the central bank manages all aspects of the system, including customer-facing activities like account provision and transaction processing. This gives the central bank complete control but requires it to develop new capabilities in customer service.

Intermediated Model

Most central banks favor an intermediated approach, where private financial institutions serve as intermediaries between the central bank and end users. This leverages existing financial infrastructure and customer relationships while maintaining the CBDC’s status as a central bank liability.

The intermediated model appears to be gaining favor among most central banks, including the Federal Reserve, as it preserves the role of private financial institutions while offering the benefits of central bank money.

Global CBDC Examples and Pilot Programs

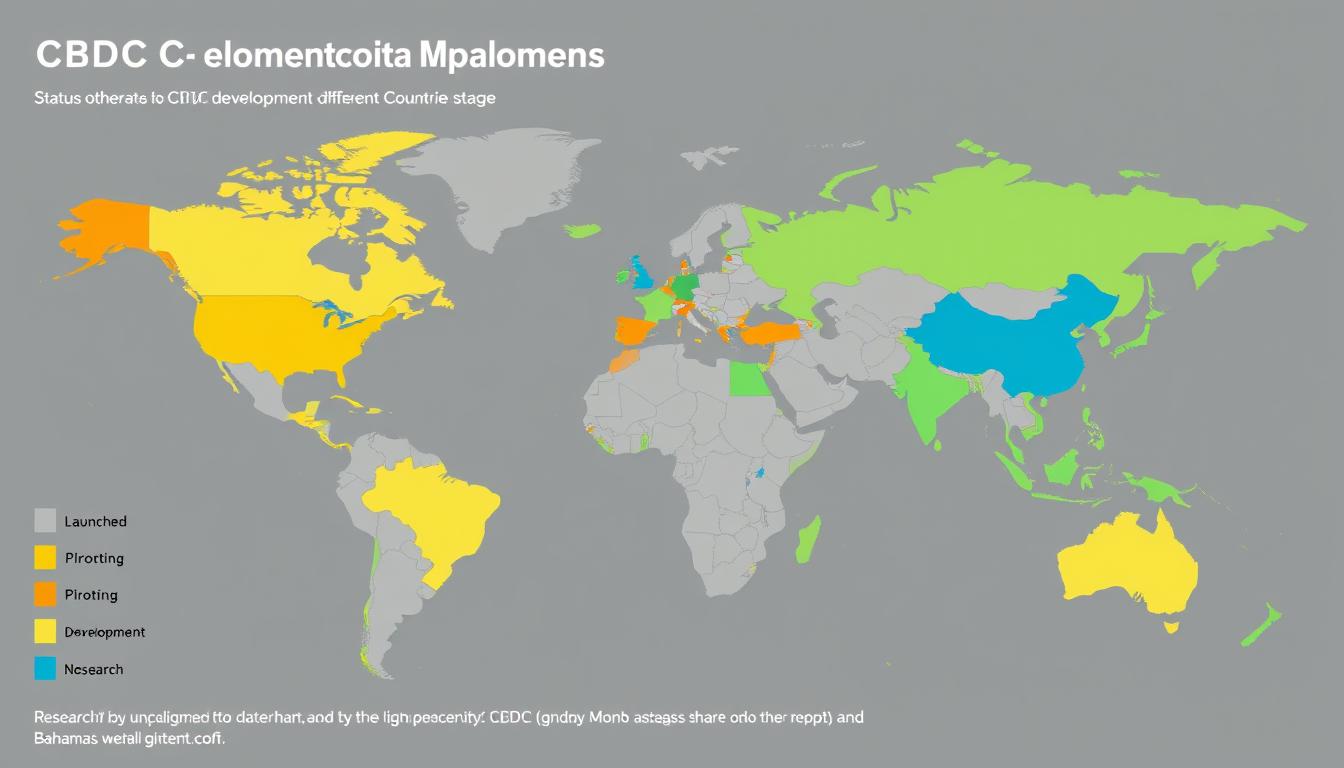

Around the world, central banks are at different stages of CBDC development, from research to full implementation. Here’s a snapshot of notable CBDC initiatives globally:

China’s Digital Yuan (e-CNY)

China leads major economies in CBDC development with its digital yuan. Already in advanced pilot stages across multiple cities, the e-CNY has been used by millions of citizens for retail transactions. The People’s Bank of China has conducted trials involving major retailers and even tested cross-border transactions.

Sweden’s e-krona

With cash usage declining rapidly, Sweden’s Riksbank has been testing an e-krona since 2020. Their pilot uses a distributed ledger technology approach and focuses on a retail CBDC model. The Riksbank is particularly concerned with ensuring payment system resilience in a cashless society.

The Bahamas Sand Dollar

The Bahamas became one of the first countries to officially launch a CBDC in October 2020. The Sand Dollar aims to promote financial inclusion across the nation’s many islands, where banking services can be limited. It offers a practical solution to the geographical challenges of traditional banking infrastructure.

Major Economies’ CBDC Status

| Country/Region | CBDC Name | Current Status | Key Features |

| United States | Digital Dollar (proposed) | Research phase | Privacy focus, intermediated model |

| European Union | Digital Euro | Development phase | Offline capabilities, privacy protections |

| India | Digital Rupee | Pilot phase | Wholesale and retail pilots underway |

| Japan | Digital Yen | Proof-of-concept | Testing basic functions and designs |

The Atlantic Council’s CBDC Tracker reports that 11 countries have fully launched a digital currency, while over 130 countries, representing 98% of global GDP, are exploring CBDCs. This widespread interest demonstrates the global significance of this monetary evolution.

Potential Benefits and Risks of CBDCs

As with any major financial innovation, CBDCs offer significant potential benefits while also presenting important challenges and risks that must be carefully managed.

Potential Benefits

- Financial Inclusion: CBDCs could provide banking-like services to the unbanked or underbanked populations, especially in regions with limited banking infrastructure.

- Payment Efficiency: Faster, cheaper payments, including cross-border transactions that currently take days and involve high fees.

- Reduced Fraud: Digital design could incorporate advanced security features to reduce counterfeiting and fraud compared to physical cash.

- Monetary Policy Tools: Central banks could gain new tools for implementing monetary policy, potentially including the ability to implement negative interest rates more effectively.

- Competition and Innovation: CBDCs could provide a platform for financial innovation and increase competition in payment services.

Potential Risks

- Privacy Concerns: Without proper safeguards, CBDCs could enable unprecedented financial surveillance of citizens’ transactions.

- Cybersecurity Threats: As a digital system, CBDCs would face cybersecurity risks that don’t exist with physical cash.

- Banking Sector Disruption: If consumers move significant funds from bank deposits to CBDCs, it could affect bank funding models and credit availability.

- Financial Stability Risks: During financial crises, the ease of converting bank deposits to CBDC could accelerate bank runs.

- Technical Challenges: Ensuring resilience, offline functionality, and accessibility for all citizens presents significant technical hurdles.

“Any U.S. CBDC should, among other things, provide benefits to households, businesses, and the overall economy that exceed any costs and risks; yield such benefits more effectively than alternative methods; complement, rather than replace, current forms of money and methods for providing financial services; protect consumer privacy; protect against criminal activity; and have broad support from key stakeholders.”

– Federal Reserve

Central banks worldwide are carefully weighing these benefits and risks as they design their CBDC systems. Most are emphasizing that CBDCs would complement rather than replace existing payment methods, including physical cash, which would remain available as long as public demand exists.

Frequently Asked Questions About CBDCs

Is CBDC a cryptocurrency?

No, CBDC is not a cryptocurrency. While both are digital forms of money, they differ fundamentally in several ways. CBDCs are issued and regulated by central banks, use centralized systems (or permissioned distributed ledgers), and maintain stable value like traditional currency. Cryptocurrencies like Bitcoin are typically decentralized, not issued by any central authority, and often experience price volatility.

Will CBDCs replace physical cash?

Central banks consistently state that CBDCs would complement, not replace, physical cash. The Federal Reserve, Bank of England, and European Central Bank have all committed to continuing cash issuance as long as public demand exists. CBDCs would provide an additional digital payment option alongside existing methods.

How would CBDCs affect my privacy?

Privacy design is a critical consideration in CBDC development. Most central banks aim to strike a balance between transaction privacy and preventing illicit activities. Many CBDC models propose tiered privacy, where smaller transactions receive greater privacy protections than larger ones. The specific privacy features would depend on each country’s implementation and legal framework.

When will CBDCs be available in the United States?

The United States is still in the research phase regarding a potential digital dollar. The Federal Reserve has stated that it would only proceed with CBDC issuance with explicit authorization from Congress. No timeline has been established, and the process would likely take several years from authorization to implementation.

How would I access and use a CBDC?

Most CBDC models envision access through digital wallets provided by banks and authorized payment providers, similar to existing mobile banking apps. Users would likely be able to send, receive, and store CBDCs through these applications, potentially with options for offline functionality through specialized devices or cards for those without smartphones.

The Future of Money: CBDC’s Potential Impact

Central Bank Digital Currencies represent a significant evolution in the concept of money, potentially combining the best aspects of physical cash and digital payments. As we’ve explored, the CBDC meaning extends beyond just another payment method – it represents a fundamental shift in how central banks engage with the public and manage monetary systems.

While still in various stages of development worldwide, CBDCs could transform financial inclusion, payment efficiency, and even monetary policy implementation. However, their success will depend on thoughtful design that balances innovation with privacy protection, financial stability, and public acceptance.

As central banks continue their CBDC exploration, the coming years will reveal which models and approaches gain traction. What’s clear is that the future of money is increasingly digital, and CBDCs will likely play a significant role in shaping that future.

Stay Updated on CBDC Developments

The world of digital currencies is evolving rapidly. Subscribe to our newsletter to receive the latest updates on CBDCs, regulatory changes, and implementation timelines from central banks worldwide. Email AddressSubscribe for Updates

Download Our Free CBDC Comparison Guide

Want a deeper understanding of how CBDCs compare to cryptocurrencies and traditional banking? Our comprehensive guide breaks down the technical differences, use cases, and potential impacts of each currency type.Download Free Guide

Explore Our Interactive CBDC Tracker

Stay up-to-date with CBDC developments worldwide through our interactive map. Track implementation stages, key features, and the latest announcements from central banks across the globe.View Interactive Tracker

Join Our CBDC Discussion Community

Connect with experts and enthusiasts to discuss the latest developments in CBDCs and digital currencies. Share insights, ask questions, and stay at the forefront of the evolving digital money landscape.Join the Community