Best CBDC Wallets in 2024: Secure & User-Friendly Options

Central Bank Digital Currencies (CBDCs) are rapidly gaining momentum worldwide, with over 130 countries currently exploring or developing these government-backed digital assets. As CBDCs move from concept to reality, having a secure and reliable wallet becomes essential for accessing, storing, and transacting with these digital versions of national currencies.

Whether you’re preparing for the digital euro, e-yuan, or other emerging CBDCs, choosing the right wallet now can position you for seamless adoption. This guide examines the most promising CBDC wallet options based on security features, compatibility with existing financial systems, and readiness for the evolving CBDC landscape.

How We Selected the Best CBDC Wallets

With CBDCs still in various stages of development globally, we’ve evaluated wallets based on their current capabilities and future readiness to support central bank digital currencies. Our comprehensive assessment focused on these critical factors:

Key factors in evaluating CBDC wallet quality and functionality

Security Features

Security is paramount when dealing with digital currencies backed by central banks. We prioritized wallets offering robust encryption, multi-factor authentication, biometric verification, and secure backup options. Wallets with hardware security elements or those developed with government partnerships received higher rankings.

Cross-Platform Compatibility

The best CBDC wallets should work seamlessly across multiple devices and operating systems. We evaluated mobile apps (iOS and Android), desktop applications, and browser extensions to ensure users can access their digital currencies wherever they are.

User Interface & Transaction Speed

Even the most secure wallet will frustrate users if it’s difficult to navigate. We assessed the intuitiveness of each wallet’s interface, the clarity of transaction processes, and the speed at which transactions are processed and confirmed.

Regulatory Compliance

Unlike many cryptocurrencies, CBDCs will operate within regulatory frameworks established by central banks. We favored wallets that demonstrate compliance with financial regulations, KYC (Know Your Customer) procedures, and those that have established relationships with financial institutions or central banks.

Customer Support

When issues arise with financial applications, responsive customer support is crucial. We evaluated the availability, responsiveness, and quality of customer support offered by each wallet provider, including multiple support channels and educational resources.

Top 7 CBDC Wallets for 2024

Based on our comprehensive evaluation, these wallets stand out for their potential to support CBDCs while offering excellent security and user experience. As central bank digital currencies continue to develop, these platforms are positioning themselves at the forefront of adoption.

1. Ripple CBDC Platform Wallet

Developed by Ripple, a company with extensive experience in cross-border payment solutions, this wallet leverages their expertise in working with central banks worldwide. The Ripple CBDC Platform Wallet is designed specifically for the emerging CBDC ecosystem, with features tailored to government-issued digital currencies.

- Key Feature: Private ledger technology designed specifically for central banks

- Best For: Users seeking a wallet with established central bank partnerships

Pros

- Partnerships with multiple central banks

- Advanced security architecture

- Cross-border CBDC compatibility

- Institutional-grade security

Cons

- Limited availability in some regions

- Primarily focused on institutional use

- Requires KYC verification

Ready to explore Ripple’s CBDC solution?

Learn more about how Ripple is working with central banks to develop secure, efficient CBDC implementations.Visit Official Site

2. G+D Filia Wallet

Giesecke+Devrient (G+D), a global security technology group, has developed the Filia platform specifically for CBDCs. Their wallet solution stands out for its ability to enable offline transactions, making it accessible even in areas with limited connectivity or during network outages.

- Key Feature: Offline transaction capability

- Best For: Users in areas with unreliable internet connectivity

Pros

- Offline transaction support

- Developed by established security technology provider

- Privacy-preserving architecture

- Pilot programs with multiple central banks

Cons

- Limited consumer availability

- Currently focused on pilot programs

- Less intuitive interface than some competitors

Interested in G+D’s CBDC solution?

Discover how G+D’s Filia platform is enabling secure offline transactions for central bank digital currencies.Learn More

3. Ledger CBDC Edition

Leveraging their expertise in hardware security, Ledger has developed a specialized version of their popular hardware wallet designed to support CBDCs. This cold storage solution offers institutional-grade security while maintaining user-friendly access to central bank digital currencies.

- Key Feature: Hardware-level security with CBDC support

- Best For: Security-conscious users seeking cold storage for CBDCs

Pros

- Military-grade security chip

- Offline private key storage

- Support for multiple CBDCs

- Established reputation in crypto security

Cons

- Higher cost than software wallets

- Requires physical device

- Less convenient for frequent transactions

Prioritize security for your digital currencies

Explore Ledger’s hardware security solutions designed to support the future of CBDCs.Check Availability

4. Novi (Meta’s Digital Wallet)

Meta (formerly Facebook) has positioned its Novi wallet to potentially support CBDCs in the future. With its massive user base and technical resources, Novi could become a significant player in CBDC adoption, particularly if it integrates with Meta’s social platforms.

- Key Feature: Potential integration with social media platforms

- Best For: Users seeking seamless social media payment integration

Pros

- User-friendly interface

- Potential for widespread adoption

- Strong development resources

- Integration with messaging platforms

Cons

- Privacy concerns related to Meta

- Uncertain regulatory status

- No confirmed CBDC partnerships yet

Stay updated on Novi’s CBDC developments

Follow the latest news about Meta’s digital wallet and its potential support for central bank digital currencies. Visit Novi

5. eCNY Wallet (People’s Bank of China)

China’s digital yuan (eCNY) is one of the most advanced CBDC projects globally, and the official eCNY wallet provides direct access to this digital currency. Developed by the People’s Bank of China, this wallet represents one of the few fully operational CBDC implementations available today.

- Key Feature: Direct access to China’s digital yuan

- Best For: Users in China or those transacting with Chinese businesses

Pros

- Official central bank application

- Already functional with real CBDC

- Integrated with major Chinese payment systems

- Offline transaction capability

Cons

- Limited availability outside China

- Privacy concerns regarding transaction monitoring

- Chinese language interface may be challenging

Learn about China’s digital currency progress

Discover how China is leading the way in CBDC implementation with the digital yuan.Official Information

6. CBDC-Connect by ConsenSys

ConsenSys, a leading blockchain technology company, has developed CBDC-Connect to facilitate interoperability between different central bank digital currencies. This solution aims to solve one of the major challenges in the CBDC space: enabling different national digital currencies to work together seamlessly.

- Key Feature: Cross-border CBDC interoperability

- Best For: International travelers and businesses operating across borders

Pros

- Designed for cross-border transactions

- Support for multiple CBDCs

- Built on established Ethereum technology

- Partnerships with multiple central banks

Cons

- Still in development phase

- Limited consumer availability

- Dependent on central bank adoption

Explore ConsenSys CBDC solutions

Learn how ConsenSys is building technology to connect different central bank digital currencies.Discover More

7. Bakong Wallet (National Bank of Cambodia)

Cambodia’s Bakong is one of the world’s first fully operational retail CBDCs, and its official wallet provides a glimpse into how future CBDC wallets might function. Developed by the National Bank of Cambodia, this wallet enables digital payments using the country’s national currency.

- Key Feature: Fully operational CBDC implementation

- Best For: Users in Cambodia or studying real-world CBDC applications

Pros

- Already functional with real CBDC

- QR code payment support

- Bank account integration

- Mobile-first design for accessibility

Cons

- Limited utility outside Cambodia

- Fewer advanced features than some competitors

- Language barriers for non-Khmer speakers

Study a real-world CBDC implementation

Learn about Cambodia’s pioneering approach to central bank digital currency with Bakong.Explore Bakong

CBDC Wallet Comparison

To help you choose the right CBDC wallet for your needs, we’ve compiled this comprehensive comparison of key features across our top recommendations.

| Wallet | Supported CBDCs | Security Features | Offline Capability | Platforms | Backup Options |

| Ripple CBDC Platform | Multiple (pilot stage) | Multi-signature, encryption | Limited | iOS, Android, Web | Cloud, recovery phrase |

| G+D Filia | Multiple (pilot stage) | Hardware security, biometrics | Full | iOS, Android | Secure element, recovery phrase |

| Ledger CBDC Edition | Multiple (in development) | Hardware security, PIN | Full | iOS, Android, Desktop | Recovery phrase |

| Novi | None yet (planned) | 2FA, biometrics | Limited | iOS, Android, Web | Cloud, recovery phrase |

| eCNY Wallet | Digital Yuan | Biometrics, PIN | Full | iOS, Android | Bank account recovery |

| CBDC-Connect | Multiple (in development) | Encryption, multi-signature | No | iOS, Android, Web | Recovery phrase |

| Bakong | Cambodian Riel | PIN, biometrics | Limited | iOS, Android | Bank account recovery |

Essential Security Features for CBDC Wallets

When choosing a CBDC wallet, security should be your top priority. Here are the critical security features to look for:

Multi-Factor Authentication

Look for wallets that require multiple forms of verification before allowing access to your funds. This typically includes something you know (password), something you have (device), and something you are (biometric).

Biometric Verification

Fingerprint scanning, facial recognition, and other biometric security measures add an additional layer of protection that is difficult to compromise compared to traditional passwords.

Secure Backup Solutions

The best CBDC wallets offer robust backup options, including encrypted cloud storage, recovery phrases, or hardware backup solutions to ensure you never lose access to your digital currency.

Offline Storage Capability

Wallets that can function offline or store private keys in cold storage provide enhanced protection against online threats and hacking attempts.

Encryption Standards

Look for wallets that implement advanced encryption standards to protect your data and transactions. Government-grade encryption (AES-256) is ideal for CBDC applications.

Regulatory Compliance

CBDC wallets should comply with relevant financial regulations and security standards, which often include rigorous security requirements to protect users.

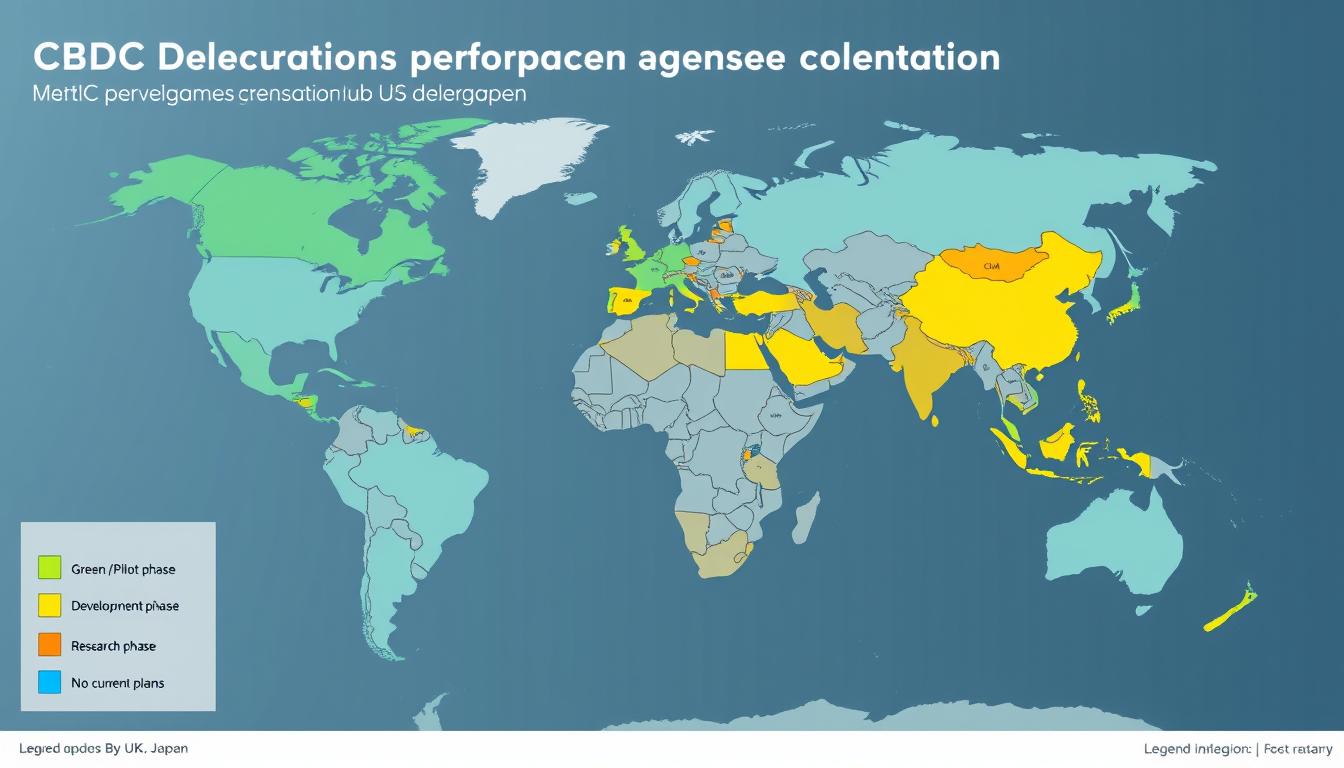

CBDC Adoption Readiness by Region

The development and implementation of CBDCs vary significantly by region. Understanding where different countries stand can help you prepare for adoption in your area.

Asia Pacific

Leading the global CBDC race with China’s digital yuan already in advanced pilot stages. Cambodia’s Bakong is fully operational, while Singapore, Japan, and South Korea are conducting extensive trials.

Europe

The European Central Bank is developing the digital euro, with pilot programs underway. Sweden’s e-krona project is also advancing rapidly, while the UK is exploring the potential for a digital pound.

Americas

The Federal Reserve is researching a digital dollar, while Canada is advancing its CBDC research. In the Caribbean, the Eastern Caribbean’s DCash is already operational across several island nations.

Stay informed about CBDC developments in your region

Subscribe to our newsletter for the latest updates on central bank digital currencies and wallet technology.Subscribe to Updates

The Future of CBDC Wallets

As central bank digital currencies continue to evolve, we can expect significant developments in wallet technology. Here are some trends to watch:

Interoperability

Future CBDC wallets will likely support multiple central bank digital currencies, allowing for seamless cross-border transactions and currency conversion within a single application.

Programmable Money

Advanced CBDC wallets will support programmable money features, enabling conditional payments, automated transactions, and integration with smart contracts for complex financial operations.

Enhanced Privacy

As privacy concerns grow, we expect to see CBDC wallets implementing more sophisticated privacy-preserving technologies while still maintaining regulatory compliance.

Digital Identity Integration

CBDC wallets will likely integrate with digital identity solutions, streamlining KYC processes while enhancing security and reducing fraud.

Offline Functionality

Improved offline transaction capabilities will become standard, ensuring CBDC access even in areas with limited connectivity or during network outages.

Financial Inclusion Tools

Future wallets will incorporate features designed to increase financial inclusion, such as simplified interfaces, multi-language support, and accessibility options.

Conclusion: Choosing the Right CBDC Wallet

As central bank digital currencies move from concept to reality, selecting the right wallet becomes increasingly important. For beginners and those prioritizing ease of use, the Ripple CBDC Platform and Novi wallets offer user-friendly interfaces with strong security. Security-conscious users should consider hardware solutions like the Ledger CBDC Edition or G+D Filia with offline capabilities.

For businesses and those operating internationally, CBDC-Connect by ConsenSys offers promising interoperability features. Meanwhile, the eCNY and Bakong wallets provide valuable insights into fully operational CBDC implementations.

As the CBDC landscape continues to evolve, wallet technology will advance rapidly. Stay informed about developments in your region and be prepared to adapt as these government-backed digital currencies become more widespread.

Prepare for the future of digital currency

Explore our recommended CBDC wallets and stay ahead of the digital currency revolution.Review Top Wallets

Related Resources

How CBDCs Work

Understand the technology behind central bank digital currencies and how they differ from cryptocurrencies and traditional money.

CBDC Security Best Practices

Learn essential security measures to protect your central bank digital currencies from theft and unauthorized access.

CBDC vs. Cryptocurrency

Explore the key differences between central bank digital currencies and traditional cryptocurrencies like Bitcoin.

Frequently Asked Questions About CBDC Wallets

What is a CBDC wallet?

A CBDC wallet is a digital application that allows users to store, send, receive, and manage central bank digital currencies. These wallets can be software-based (mobile apps, desktop applications, or web platforms) or hardware-based (physical devices). Unlike cryptocurrency wallets, CBDC wallets are designed to work with government-issued digital currencies and often include features for regulatory compliance.

Are CBDC wallets different from crypto wallets?

Yes, while both store digital assets, CBDC wallets are specifically designed for government-issued digital currencies. They typically include features for regulatory compliance, may have built-in identity verification, and are often developed in partnership with central banks. Many CBDC wallets also offer integration with existing banking systems, which is less common with traditional crypto wallets.

When will CBDCs be widely available?

The timeline varies by country. China’s digital yuan is already in advanced pilot stages, while the Bahamas Sand Dollar and Cambodia’s Bakong are fully operational. The European Central Bank aims to launch the digital euro by 2026, and many other countries are in various stages of research and development. Most major economies are expected to have CBDCs available within the next 3-5 years.

Will I need a special wallet for each country’s CBDC?

Initially, many CBDCs will have their own dedicated wallets, especially those developed directly by central banks. However, we’re already seeing wallet providers like Ripple and ConsenSys developing solutions that can support multiple CBDCs. As the technology matures, multi-currency CBDC wallets will likely become more common, similar to how many crypto wallets today support multiple cryptocurrencies.

Are CBDC wallets secure?

CBDC wallets are designed with security as a priority, often implementing advanced encryption, multi-factor authentication, and biometric verification. Many also offer offline transaction capabilities to protect against network-based attacks. Since CBDCs are backed by central banks, their wallets typically undergo rigorous security testing and must comply with financial regulations, potentially making them more secure than some cryptocurrency wallets.