China’s digital yuan (e-CNY) represents one of the most ambitious central bank digital currency (CBDC) projects in the world. As the first major economy to launch a digital version of its national currency, China is pioneering a new approach to money that could reshape global finance. This comprehensive guide explores the e-Yuan’s development, technology, implementation, and potential implications for both China and the international monetary system.

What Is the E-Yuan? Understanding China’s Digital Currency

The digital yuan, officially known as the Digital Currency Electronic Payment (DCEP) or e-CNY, is China’s version of a central bank digital currency. Unlike cryptocurrencies such as Bitcoin, the e-Yuan is issued and controlled by China’s central bank, the People’s Bank of China (PBOC). It’s designed as a digital version of the standard yuan, maintaining a 1:1 peg with China’s physical currency.

The e-CNY functions as legal tender in China and aims to digitize cash transactions rather than replace existing electronic payment systems. It enables instant transfers between users and can operate even when both parties are offline—a technological advantage over many existing payment solutions.

“The digital yuan is designed to move instantaneously in both domestic and international transactions. It aims to be cheaper and faster than existing financial transactions. The technology enables transactions to take place between two offline devices.”

Stay Updated on Digital Currency Developments

Subscribe to our newsletter for the latest insights on e-Yuan and other central bank digital currencies.

Development Timeline: The E-Yuan’s Journey

The development of China’s digital currency began in 2014 under the leadership of then-PBOC Governor Zhou Xiaochuan. Here are the key milestones in the e-Yuan’s development:

| Year | Milestone | Significance |

| 2014 | Research begins at PBOC | Initial exploration of digital currency concepts |

| 2016 | Digital Currency Research Institute established | Formalization of research efforts |

| 2017 | State Council approval | Official government backing for development |

| 2019 | PBOC announces digital renminbi | Public confirmation of the project |

| 2020 | Initial pilot testing in four cities | First real-world implementation |

| 2021 | Expansion to additional cities; public transport integration | Broadening use cases and adoption |

| 2022 | Winter Olympics implementation; further expansion | International showcase and domestic growth |

| 2023 | SIM card-based e-CNY wallets; cross-border oil settlement | Technical innovation and international use |

The e-Yuan has expanded from initial testing in Shenzhen, Suzhou, Chengdu, and Xiong’an to now include 29 pilot areas across China. This gradual rollout has allowed the PBOC to refine the technology and address challenges before nationwide implementation.

Technology and Infrastructure Behind the E-Yuan

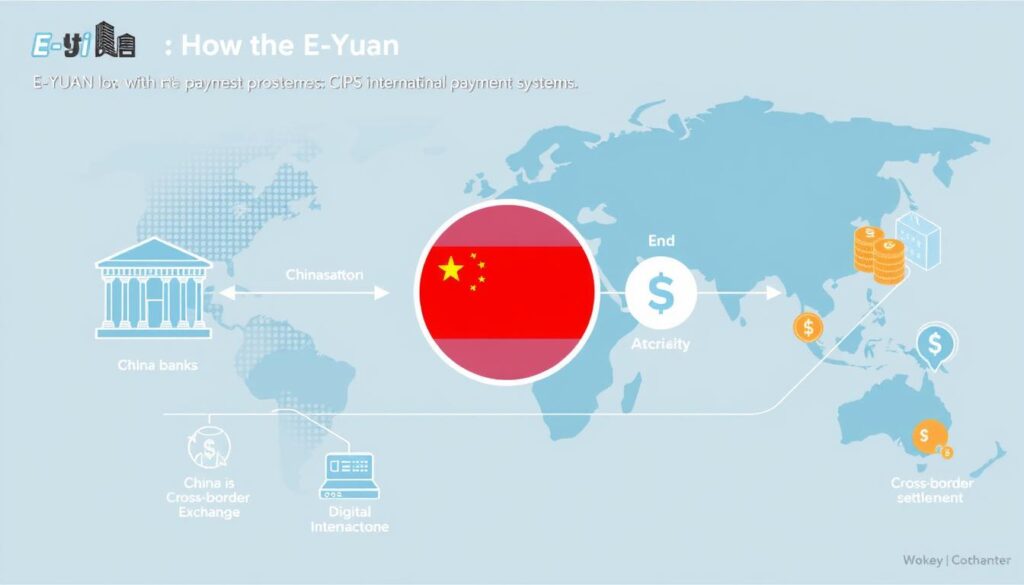

The e-CNY operates on a two-tier system where the People’s Bank of China issues the digital currency to commercial banks, which then distribute it to the public. This preserves the existing financial system while adding digital capabilities.

How E-Yuan Differs from Cryptocurrencies

E-Yuan Characteristics

- Centralized control by PBOC

- Legal tender status

- Stable 1:1 value with physical yuan

- Requires identity verification

- Supports offline transactions

- “Controllable anonymity” for privacy

Cryptocurrency Characteristics

- Decentralized networks

- Not legal tender in most countries

- Price determined by market forces

- Often pseudonymous or anonymous

- Typically requires internet connection

- Varying degrees of transaction privacy

Comparison with Existing Payment Systems

China already has widespread adoption of digital payment platforms like Alipay and WeChat Pay, which together account for over 90% of mobile payments in China. The e-Yuan enters a mature digital payment ecosystem but offers several key differences:

| Feature | E-Yuan (e-CNY) | WeChat Pay/Alipay |

| Issuer | People’s Bank of China (central bank) | Private companies (Tencent/Ant Group) |

| Legal Status | Legal tender | Private payment system |

| Offline Capability | Yes, supports offline transactions | No, requires internet connection |

| Transaction Fees | Lower or zero fees | 0.1% for transfers outside ecosystem |

| Bank Account Requirement | Not always required (depends on wallet tier) | Required for full functionality |

The E-Yuan Wallet System

The e-CNY wallet system features a tiered structure with varying levels of anonymity, transaction limits, and verification requirements. This design balances accessibility with regulatory compliance.

Wallet Types and Specifications

Personal and Corporate Wallets

Individuals and business owners can open personal wallets, while legal entities can access corporate wallets. Transaction limits vary based on verification level and whether the account was opened remotely or in person.

Soft and Hard Wallets

Soft wallets include mobile apps and services provided through software development kits. Hard wallets encompass physical options like IC cards, wearable devices, and IoT-enabled payment tools.

Master and Sub-wallets

Users can designate a master e-CNY wallet and create multiple sub-wallets with customized payment limits and conditions, helping to manage spending and protect privacy.

Wallet Limits

The highest anonymity wallet requires only a mobile number and has lower transaction limits (2,000 yuan single payment, 5,000 yuan daily limit). Fully verified wallets linked to bank accounts have significantly higher limits (50,000 yuan single payment, 500,000 yuan balance cap).

Understand Digital Currency Security

Download our free guide on protecting your digital assets in the age of CBDCs.

Current Adoption and Implementation

As of 2024, the e-Yuan has been implemented across 29 pilot areas in China, with varying levels of adoption and integration. While the Chinese government describes these as “pilots,” the implementation appears to be moving toward full-scale deployment.

Real-World Use Cases

Public Transportation

The e-Yuan has been integrated into public transit systems in major cities, including Beijing where it’s accepted across all 24 subway lines, and Chengdu, which was the first to fully implement e-CNY payments for buses and subways.

Retail Payments

Major retailers and restaurants including Starbucks, McDonald’s, and JD.com accept e-Yuan payments. The government has distributed millions in e-CNY through “red packets” (digital hongbao) to stimulate adoption and consumption.

Cross-Border Transactions

In 2023, PetroChina conducted the first cross-border crude oil settlement using digital yuan, marking a significant step toward international use. Hong Kong has also begun piloting e-CNY acceptance for cross-border payments.

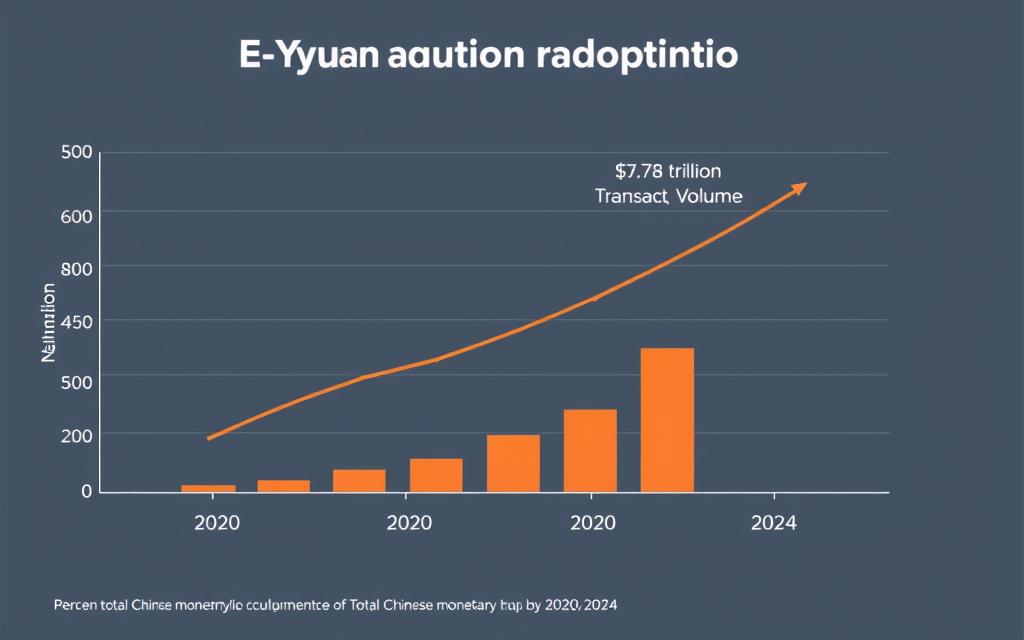

Adoption Metrics

According to the Digital Currency Research Institute, by mid-2024, approximately 180 million e-CNY wallets had been created with cumulative transactions reaching $7.3 trillion. However, this represents just a fraction of China’s total monetary volume—about 0.16% as of 2023 reporting.

Despite government backing, adoption faces challenges as many Chinese consumers are satisfied with existing digital payment options like Alipay and WeChat Pay, which already have over a billion users each and are used by more than 90% of the population in China’s largest cities.

Global Implications of the E-Yuan

Challenge to Dollar Dominance

One of the most discussed implications of the e-Yuan is its potential to challenge the U.S. dollar’s dominance in international trade and finance. While the Chinese government has stated that “the goal is not to replace the U.S. dollar,” the e-Yuan could contribute to the internationalization of the renminbi.

“If China were able to expand the reach of its own payment systems and reduce the importance of SWIFT and the U.S. dollar as the world reserve currency, then it would be in a much better position to avoid the impact of U.S. sanctions.”

However, many experts believe that significant barriers remain to the yuan becoming a major reserve currency. These include China’s capital controls, property rights concerns, and the perception of the U.S. dollar as a safer asset. Currently, the U.S. dollar accounts for over 60% of global reserves, while the renminbi represents only about 2%.

Cross-Border Payment Systems

China has developed the Cross-Border Interbank Payment System (CIPS) as an alternative to SWIFT, the Western-dominated international payment messaging system. Combined with the e-Yuan, this could create an independent financial infrastructure less vulnerable to Western sanctions.

The country is also participating in Project M-Bridge with other central banks to develop wholesale CBDCs for cross-border transactions, though the Bank for International Settlements reportedly withdrew from the project in late 2024.

Privacy Considerations and Surveillance Concerns

The e-Yuan has raised significant privacy concerns due to the potential for increased financial surveillance. While the PBOC has introduced the concept of “controllable anonymity,” the central bank maintains visibility over transaction data and user identities.

Privacy Tiers: The e-Yuan offers different levels of privacy based on wallet verification. However, even the highest “anonymity” tier requires a mobile phone number, which in China is typically linked to real identity through SIM card registration requirements.

For international users and businesses operating in China, this means that financial activities conducted using the e-Yuan could be monitored by Chinese authorities. As Darrell Duffie of Stanford notes, “Anyone using the e-CNY should be warned that China’s central bank can see your payment activity… And if China’s Communist Party, acting through state security agencies, were to demand data from the People’s Bank of China, the PBOC would be required to comply.”

The e-Yuan also gives the central bank unprecedented control over money, including the ability to expire funds (as demonstrated in pilot programs) and potentially restrict transactions based on government policies.

Future Prospects and Global Response

As China continues to develop and expand its digital currency, other major economies are accelerating their own CBDC research and development. The European Central Bank is exploring a digital euro, while the U.S. Federal Reserve is researching a potential digital dollar.

Potential Evolution of the E-Yuan

Looking ahead, the e-Yuan is likely to see further domestic expansion and increased international use cases. Key developments may include:

- Greater integration with China’s Belt and Road Initiative to facilitate cross-border transactions

- Expanded use in international commodity settlements, particularly with countries seeking alternatives to dollar-based trade

- Enhanced technical features to improve user experience and compete with private payment platforms

- Potential integration with other countries’ CBDCs through multi-CBDC platforms

Implications for Other Countries

China’s head start in CBDC development has created both challenges and opportunities for other nations:

Challenges

- Potential erosion of monetary sovereignty for smaller economies

- Reduced effectiveness of sanctions and financial controls

- Privacy and data security concerns in cross-border transactions

Opportunities

- Learning from China’s implementation experience

- Developing improved CBDC models with stronger privacy protections

- Creating new international standards for digital currency interoperability

Prepare for the Digital Currency Future

Join our webinar series on how central bank digital currencies will transform global finance.

Conclusion: The E-Yuan’s Place in the Future of Money

The e-Yuan represents a significant milestone in the evolution of money, marking the first major economy’s full-scale implementation of a central bank digital currency. While its domestic adoption faces competition from entrenched private payment platforms, its international implications could be far-reaching.

As a tool for financial innovation, the e-Yuan offers genuine technological advantages including offline transactions, reduced costs, and greater financial inclusion. However, it also raises important questions about privacy, surveillance, and the changing nature of monetary sovereignty in the digital age.

Whether the e-Yuan will achieve China’s goal of internationalizing the renminbi remains to be seen, but its development has already accelerated the global conversation about the future of money. As other countries develop their own CBDCs in response, we are witnessing the early stages of a transformation in how money functions in the digital era—a transformation that China is currently leading.

Adam G

This post was created by Adam G, a seasoned financial writer with a passion for explaining currency exchange and market movements