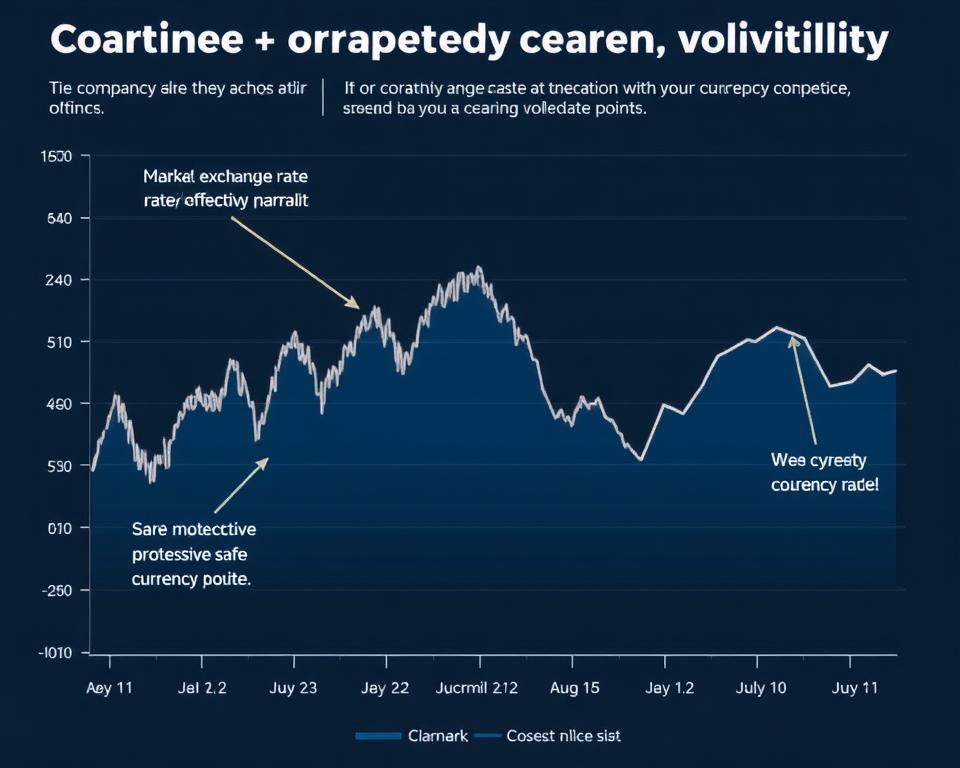

In today’s volatile global economy, currency fluctuations can significantly impact your wealth and financial stability. Whether you’re an individual investor or a business owner dealing with international transactions, having robust safe currency strategies is no longer optional—it’s essential. Unexpected exchange rate movements can quickly erode profits, increase costs, and create budget uncertainties that affect long-term financial planning.

This guide explores proven approaches to safeguard your assets against currency volatility. We’ll examine practical hedging techniques, diversification strategies, and implementation steps that both individuals and businesses can use to navigate uncertain markets with confidence. By the end, you’ll have a clear roadmap for protecting your wealth from the unpredictable nature of global currency markets.

Understanding Currency Risk in Today’s Global Economy

Currency risk represents the potential for financial loss due to changes in exchange rates. In an increasingly interconnected world, this risk affects more people than ever before—from multinational corporations to individual investors with diversified portfolios. Understanding the nature of this risk is the first step toward implementing effective safe currency strategies.

Key Insight: Currency fluctuations can impact your wealth in three primary ways: directly through currency holdings, indirectly through investments in foreign markets, and operationally through business transactions across borders.

Recent global events have demonstrated how quickly currency markets can shift. Political developments, economic data releases, central bank decisions, and even social media announcements can trigger significant exchange rate movements within minutes. These rapid changes create an environment where reactive approaches often fail, making proactive currency risk management essential.

Strategy 1: Forward Contracts – Locking in Exchange Rates

Forward contracts represent one of the most straightforward and effective safe currency strategies available. These financial instruments allow you to lock in an exchange rate today for a transaction that will occur at a specified future date. This approach eliminates uncertainty by providing a guaranteed rate regardless of market movements.

How Forward Contracts Work

When you enter into a forward contract, you agree with a financial provider to exchange a specific amount of currency at a predetermined rate on a future date. This creates certainty in your financial planning and protects against unfavorable rate movements. For example, if you know you’ll need to convert $100,000 to euros in three months, a forward contract lets you secure today’s rate, even if the dollar weakens against the euro during that period.

“Forward contracts are like insurance policies against currency volatility. They provide certainty in an uncertain market, allowing businesses and investors to focus on their core activities rather than worrying about exchange rate movements.”

Ideal Scenarios for Forward Contracts

- When you have fixed payment dates for international transactions

- During periods of expected currency volatility

- When your business operates on thin profit margins that could be erased by currency movements

- For large one-time transactions where certainty is crucial

Need Help Setting Up Forward Contracts?

Our currency specialists can help you implement forward contracts tailored to your specific needs and risk profile.

Strategy 2: Currency Diversification – Spreading Your Risk

Diversification is a cornerstone of safe currency strategies. Just as you wouldn’t put all your investment dollars into a single stock, holding all your liquid assets in one currency exposes you to unnecessary risk. Currency diversification involves strategically allocating your holdings across multiple currencies to reduce overall volatility and risk exposure.

Building a Balanced Currency Portfolio

An effective diversification strategy considers both traditional safe-haven currencies and emerging market opportunities. The goal is to create a balance where weakness in one currency might be offset by strength in others. This approach doesn’t eliminate currency risk entirely, but it can significantly reduce its impact on your overall wealth.

| Currency Type | Examples | Stability Rating | Best Used For |

| Traditional Safe Havens | USD, CHF, JPY | High | Core holdings, crisis protection |

| Commodity-Backed | CAD, AUD, NOK | Medium-High | Inflation hedging, resource market exposure |

| Major Trading Currencies | EUR, GBP | Medium | Trade facilitation, liquidity |

| Emerging Markets | SGD, KRW, MXN | Medium-Low | Growth potential, regional exposure |

| Digital Currencies | Bitcoin, Stablecoins | Variable | Diversification, technology exposure |

When implementing a diversification strategy, consider your personal or business exposure to different economies and adjust your currency holdings accordingly. For instance, if your business imports heavily from Europe, holding some euros can provide a natural hedge against exchange rate fluctuations.

Strategy 3: Natural Hedging – Aligning Income and Expenses

Natural hedging represents one of the most cost-effective safe currency strategies available, particularly for businesses engaged in international trade. This approach involves structuring your operations so that your income and expenses in a particular currency are balanced, reducing your net exposure to exchange rate fluctuations.

Implementing Natural Hedging in Business Operations

For businesses, natural hedging might involve setting up operations or banking relationships in countries where you have significant customer bases or supplier networks. By matching revenues and expenses in the same currency, you create a built-in protection mechanism that requires no financial instruments or additional costs.

For Businesses:

- Invoice international customers in your home currency when possible

- Source supplies from countries where you generate revenue

- Establish operations in key markets to create natural currency alignment

- Negotiate contracts with currency adjustment clauses

For Individuals:

- Hold currencies of countries where you have regular expenses

- Consider investment properties in regions you frequently visit

- Match investment currencies with future spending plans

- Maintain multi-currency accounts for regular international activities

Real-World Example: A Canadian manufacturing company that sells products to US customers opened a US bank account and began paying its American suppliers directly from US dollar revenues. This natural hedge eliminated the need to convert currencies for each transaction, saving approximately 3.5% in exchange costs and protecting against CAD/USD fluctuations.

Strategy 4: Multi-Currency Accounts – Operational Flexibility

Multi-currency accounts have emerged as a powerful tool in implementing safe currency strategies. These specialized banking products allow you to hold, manage, and transact in multiple currencies within a single account structure. For both businesses and individuals engaged in international activities, these accounts provide operational flexibility and reduce unnecessary conversion costs.

Benefits of Multi-Currency Accounts

The primary advantage of multi-currency accounts is the ability to receive and make payments in native currencies without forced conversions. This capability eliminates the spread costs and timing risks associated with frequent currency exchanges. Additionally, these accounts often provide competitive exchange rates when you do need to convert between currencies.

Key Features to Look For:

- Low or no monthly maintenance fees

- Competitive exchange rates with transparent fee structures

- Local account details for major currencies (IBAN, Sort Code, etc.)

- Online platform with real-time currency monitoring

- Integration with accounting software for businesses

- International payment capabilities with reasonable fees

When selecting a multi-currency account provider, consider both traditional banks and fintech platforms. While traditional banks may offer more comprehensive services, fintech solutions often provide more competitive rates and user-friendly interfaces. Your choice should align with your specific needs and transaction patterns.

Strategy 5: Currency Options – Flexible Protection

Currency options represent a more sophisticated approach within the spectrum of safe currency strategies. Unlike forward contracts that lock you into a specific rate, options give you the right—but not the obligation—to exchange currency at a predetermined rate before a specific expiration date. This flexibility comes at a cost (the option premium), but provides valuable protection with upside potential.

How Currency Options Protect Your Wealth

Think of currency options as insurance policies against adverse exchange rate movements. You pay a premium upfront for protection, but if rates move in your favor, you can let the option expire and take advantage of the better market rate. This combination of downside protection with upside potential makes options particularly valuable during periods of high currency volatility.

Advantages of Currency Options

- Protection against unfavorable currency movements

- Ability to benefit from favorable currency movements

- Known maximum cost (the premium paid)

- Customizable strike prices and expiration dates

- No obligation to execute if market conditions are better

Limitations to Consider

- Upfront premium cost regardless of execution

- More complex to understand and implement

- Typically requires larger transaction sizes

- May need professional guidance to structure properly

- Premium costs can be significant in volatile markets

Currency options are particularly valuable for businesses with uncertain payment timelines or individuals making large one-time international purchases, such as real estate. The flexibility they provide can be worth the premium cost in situations where timing flexibility adds significant value.

Traditional vs. Digital Safe-Haven Currencies

The landscape of safe-haven currencies has evolved significantly with the emergence of digital alternatives. While traditional safe-haven currencies like the US Dollar, Swiss Franc, and Japanese Yen have long histories of relative stability, digital currencies are challenging this paradigm with different value propositions. Understanding the strengths and limitations of each can help you develop more comprehensive safe currency strategies.

| Characteristic | Traditional Safe-Haven Currencies | Digital Currencies |

| Historical Stability | Established track record over decades | Limited history, still evolving |

| Inflation Protection | Variable; subject to monetary policy | Some offer fixed supply (Bitcoin); stablecoins vary |

| Accessibility | Requires banking relationships | Accessible with internet connection |

| Volatility | Relatively low | Generally high (except some stablecoins) |

| Regulatory Framework | Well-established | Evolving, uncertain in many jurisdictions |

| Seizure Resistance | Low to moderate | Potentially high with proper security |

Emerging Trends in Safe-Haven Currencies

The concept of what constitutes a “safe” currency is evolving. Traditionally, currencies backed by stable governments with strong economic fundamentals were considered safe havens. Today, factors like inflation resistance, censorship resistance, and portability are increasingly important considerations in safe currency strategies.

The ideal currency portfolio today combines traditional safe havens with select digital assets, creating a balance between established stability and protection against emerging monetary risks.

Real-World Examples of Successful Currency Protection

Case Study 1: Manufacturing Business Surviving Currency Crisis

A medium-sized manufacturing company with suppliers in Asia and customers in North America faced significant challenges during a period of extreme currency volatility. By implementing a combination of forward contracts for known payment dates and currency options for variable-timing transactions, the company maintained stable pricing while competitors were forced to raise prices or accept margin compression.

Their approach included:

- Hedging 75% of expected currency needs with 3-month forward contracts

- Using currency options for the remaining 25% to maintain flexibility

- Establishing a natural hedge by sourcing some components locally

- Implementing currency adjustment clauses in long-term contracts

Case Study 2: Individual Investor Preserving Retirement Savings

An investor approaching retirement recognized the risk of having all assets denominated in a single currency. By diversifying across five major currencies and adding a small allocation to gold and digital assets, they created a balanced portfolio that maintained purchasing power despite significant volatility in their home currency.

Key Insight: The most successful implementations of safe currency strategies don’t rely on a single approach. Instead, they combine multiple techniques tailored to specific risk exposures and financial objectives.

Actionable Steps to Implement Safe Currency Strategies

Moving from theory to practice requires a structured approach. The following implementation framework provides a step-by-step process for developing and executing effective safe currency strategies for both individuals and businesses.

- Assess your currency exposure (travel, investments, future plans)

- Determine your risk tolerance and protection needs

- Research and open multi-currency accounts

- Allocate funds across 3-5 stable currencies

- Consider physical precious metals for 5-10% of holdings

- Evaluate digital currency options if appropriate

- Review and rebalance quarterly

For Individuals

- Map all currency exposures across operations

- Quantify potential impact of 10-20% currency movements

- Develop hedging policy with clear guidelines

- Implement forward contracts for predictable expenses

- Consider options for variable-timing transactions

- Explore natural hedging opportunities

- Review strategy effectiveness monthly

For Businesses

Working with Financial Partners

While many aspects of currency risk management can be handled independently, partnering with experienced financial service providers often leads to better outcomes. These partners can provide access to more sophisticated tools, competitive rates, and valuable market insights that inform your strategy.

Ready to Implement Your Currency Protection Plan?

Our team of currency specialists can help you develop and execute a customized strategy based on your specific needs and risk profile.

Monitoring and Adjusting Your Currency Strategy

Implementing safe currency strategies isn’t a one-time event but an ongoing process that requires regular monitoring and adjustment. Markets evolve, economic conditions change, and your personal or business circumstances may shift, all necessitating reviews of your approach.

Key Indicators to Monitor

Economic Indicators

- Interest rate differentials

- Inflation rates

- GDP growth figures

- Trade balances

Market Signals

- Currency volatility indices

- Central bank communications

- Futures market positioning

- Cross-currency correlations

Internal Metrics

- Hedging costs vs. benefits

- Exposure changes

- Risk tolerance adjustments

- Strategy performance

Creating a Review Schedule

Establish a regular cadence for reviewing your currency strategy. For businesses with significant international exposure, monthly reviews may be appropriate. For individuals, quarterly assessments often strike the right balance between vigilance and practicality. During these reviews, evaluate both the effectiveness of your current approach and any changes in your risk profile or market conditions.

“The most successful currency risk managers aren’t those who predict market movements perfectly, but those who consistently apply disciplined processes and adapt to changing conditions.”

Digital Tools for Currency Risk Management

Technology has revolutionized how individuals and businesses implement safe currency strategies. Today’s digital tools provide unprecedented access to real-time information, analytical capabilities, and execution options that were once available only to large financial institutions.

Essential Digital Resources

Monitoring Tools

- Currency alert applications

- Economic calendar integrations

- Technical analysis platforms

- Central bank announcement trackers

Execution Platforms

- Multi-currency account applications

- Foreign exchange trading platforms

- Hedging solution providers

- International payment systems

When selecting digital tools, prioritize security, reliability, and usability. The best platforms offer intuitive interfaces while providing robust functionality. Many providers now offer tiered services, allowing you to start with basic features and add more sophisticated capabilities as your needs evolve.

Common Mistakes to Avoid in Currency Risk Management

Even well-intentioned currency protection efforts can be undermined by common mistakes. Being aware of these pitfalls can help you develop more effective safe currency strategies and avoid costly errors.

Strategic Errors to Watch For

Overhedging

Protecting more than your actual exposure can create unnecessary costs and even generate new risks. Aim to hedge your actual exposure rather than speculating on market movements.

Timing the Market

Attempting to execute currency transactions at “perfect” moments often leads to missed opportunities and increased risk. Focus on consistent risk management rather than perfect timing.

Ignoring Transaction Costs

Hidden fees, spreads, and other costs can significantly impact the effectiveness of your currency strategy. Always calculate the all-in cost of any approach before implementation.

Set-and-Forget Mentality

Currency markets and your exposure to them evolve constantly. Failing to review and adjust your strategy regularly can leave you vulnerable to changing conditions.

Critical Warning: Never implement a currency strategy you don’t fully understand. Complex derivatives and structured products may offer attractive features but can create unexpected risks if their mechanics aren’t clear to you.

Your Safe Currency Strategy Implementation Checklist

Use this comprehensive checklist to guide your implementation of safe currency strategies. Whether you’re an individual investor or business owner, these steps will help ensure you’ve covered the essential elements of currency risk management.

Assessment Phase

- Quantify your total currency exposure (amounts and currencies)

- Identify timing of expected currency flows (known vs. variable dates)

- Determine your risk tolerance and protection objectives

- Assess available resources (time, expertise, capital)

- Research current market conditions and forecasts

Strategy Development

- Select appropriate hedging tools based on your needs

- Determine optimal currency diversification mix

- Identify natural hedging opportunities

- Set clear risk management parameters and limits

- Document your strategy with specific actions and timelines

Implementation

- Open necessary accounts (multi-currency, trading platforms)

- Execute initial hedging transactions

- Implement operational changes for natural hedging

- Set up monitoring systems and alerts

- Document all positions and strategies

Ongoing Management

- Schedule regular strategy reviews (monthly/quarterly)

- Track performance against objectives

- Adjust positions based on changing conditions

- Stay informed about relevant economic developments

- Continuously educate yourself on new tools and approaches

Securing Your Financial Future with Safe Currency Strategies

In today’s interconnected global economy, currency volatility is an unavoidable reality. However, with the right safe currency strategies, you can transform this challenge from a threat into a manageable aspect of your financial planning. The approaches outlined in this guide—from forward contracts and diversification to natural hedging and digital tools—provide a comprehensive framework for protecting your wealth against currency fluctuations.

Remember that effective currency risk management isn’t about eliminating all risk or perfectly timing the market. Instead, it focuses on creating predictability, reducing unnecessary exposure, and ensuring that currency movements don’t derail your broader financial objectives. By implementing these strategies systematically and reviewing them regularly, you can navigate even the most turbulent currency markets with confidence.

“The goal of currency risk management isn’t to profit from market movements but to ensure that currency fluctuations don’t prevent you from achieving your core financial objectives.”

Take the Next Step in Protecting Your Wealth

Our currency specialists can help you develop and implement a customized strategy based on your specific situation and objectives. Schedule a no-obligation consultation today.

Whether you’re safeguarding business profits, protecting retirement savings, or ensuring the stability of your investment portfolio, implementing effective safe currency strategies is an essential component of sound financial management in today’s global economy.

Frequently Asked Questions About Safe Currency Strategies

How much of my wealth should I protect with currency hedging?

The appropriate amount depends on your specific exposure and risk tolerance. As a general guideline, consider hedging 50-80% of known currency exposures for businesses and 15-30% of liquid assets for individuals. This provides meaningful protection while maintaining some flexibility to benefit from favorable movements.

Are digital currencies like Bitcoin suitable as safe-haven assets?

Digital currencies present a mixed profile as safe-haven assets. While Bitcoin has shown some safe-haven characteristics during specific economic events, its overall volatility makes it unsuitable as a primary safe-haven holding for most investors. Consider allocating no more than 1-5% of your portfolio to digital assets, treating them as a diversification tool rather than a core safe-haven holding.

How often should I review my currency protection strategy?

For businesses with significant international exposure, monthly reviews are recommended, with quarterly deep dives into strategy effectiveness. Individual investors should conduct thorough reviews at least quarterly, with additional checks during major market events or personal financial changes. The key is establishing a regular cadence while remaining flexible enough to respond to significant developments.

What’s the minimum amount needed to implement effective currency hedging?

While some hedging instruments like forward contracts may have minimum transaction sizes (typically ,000-,000), strategies like multi-currency accounts and natural hedging can be implemented with much smaller amounts. The key is matching the strategy to your exposure level and available resources. Even modest protection is better than none when it comes to currency risk.